Today there are about 44.5 million (13% of the population) Americans who have a student debt, with an average amount of 40,000 dollars.

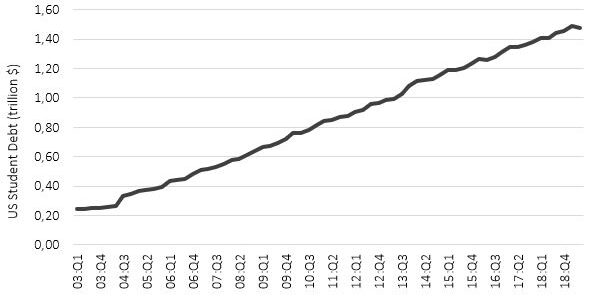

US Studend Debt Growth

In the United States it is very common to resort to loans, from the purchase of homes, cars and household appliances, to other expenditure such as credit cards and university. In the last few years, debts contracted by students to access and attend US universities have grown enormously. The costs, not only of private universities, but also of public ones, are very high: the average fee is about $20,000 a year. Most families cannot afford to spend so much, so the only solution are loans. Since the 1980s, both the number of students and the fees to be paid have grown a lot. As a result of the increase in university costs, the request for funding has also grown. Increasingly, graduate school represents a greater percentage of this debt as more and more students are pushed into graduate programs due to the loss of value on bachelor’s degrees. Today the debts incurred to finance studies are second only to those aimed at buying a house. They represent about 11% of total US private debt. Since 2003 the total indebtedness of American university students has grown very rapidly to $1.48 trillion (Figure 1), at a rate of around 100 billion per year.

Figure 1: US student debt (Source: New York Fed Consumer Credit Panel/Equifax)

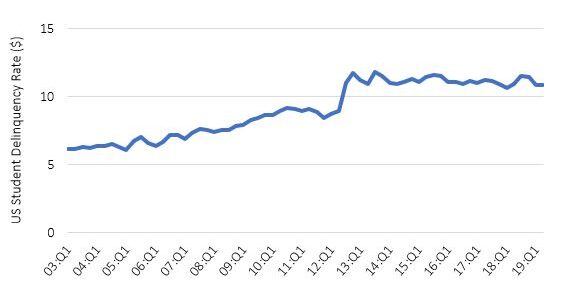

US Student Delinquency Rate

Not only student debt is growing, but also the student delinquency rate is (Figure 2). This means that people's ability to repay debts resulting from education is diminishing. In the years following the crisis, unlike the insolvency rates on other types of debt, that related to students has increased considerably. Today it has reached a percentage of around 10.8%, against the values of 4.6%, 8.3% and 0.9% respectively for cars, credit cards and mortgages. We are also at significantly higher levels than those before the 2008 crisis, which were around 7%.

Figure 2: US student delinquency rate (Source: New York Fed Consumer Credit Panel/Equifax)

More than 60% of people with student debt are above 30 years old.

Who Holds the US Student Loan Debt?

Surprisingly, it's not just the younger generations struggling with debt. Of the people with student debt, only 37.5% are under 30 years old. It is not surprising, however, that minorities are disproportionately influenced by student debt. The 77% of black students have signed a loan to pay education higher than the national average. Even the average debt at graduation is higher for black students. In 2012, for example, it was around $29,344 compared to the national average of $25,640. However, the problems do not end after finding a job, because among workers with a university degree or higher, black families still earn 23% less than the average. The debt problem also has a particularly significant weight for women. They represent around 56% of university students and hold almost two-thirds of the total debt. In addition, their average debt is about $2700 greater than that of a man. Women also take more time to repay it, resulting in greater total interest. This is partly due to the gender pay gap: women earn on average 26% less than men, which means less money to pay debts.

To Conclude...

Considering what has been said so far, it is possible to conclude that today the financial situation for younger consumers, weighed down by the increase in student debt and by relatively high insolvency rates, is critical. The problem is large and very perceived by the population, because often those who take on these debts carry them for the rest of their lives. In fact, they are repaid very slowly and, in many cases, not completely. A considerable part of student loans is in a kind of limbo or completely abandoned. Currently about 3-4 million borrowers are postponing their loans and even 5 million have their loans in default. We therefore think it is important to monitor the evolution of this situation. All this could have extremely negative consequences on the economy since students who must pay school debt are less likely to start a family, buy a house and consume. In fact, according to some research, student loan debt is the reason why around 13% of Americans decide not to have kids. This also risks being even more aggravated by the low wage growth that has characterized the United States in recent years, thus resulting in a slowdown in future economy.