US private debt at maximum levels: recorded a 0.7% growth.

US Private Debt Evolution

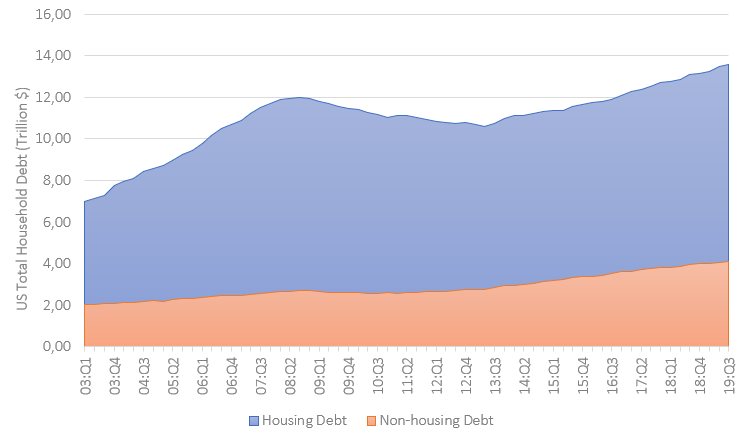

The Center for Microeconomic Data of the Federal Reserve Bank of New York published in November the quarterly report on US private debt. The figures, updated to the third quarter of 2019, show an overall increase in debt. Mortgages remain the largest slice of debt. The level of mortgage debt at the end of September was $9.44 trillion, up $31 billion (Figure 1). The total non-housing debt grew by $64 billion, with generalized increases. This marks the 21st consecutive quarter with an increase.

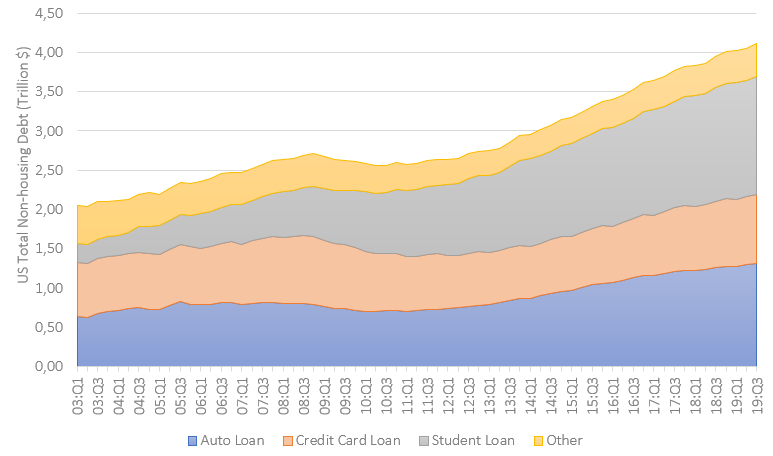

More specifically, auto loans increased by around $18 billion, credit card debts by $13 billion and student loans by $20 billion, continuing to be a sore point for American families (Figure 2).

US Delinquency Rates Evolution

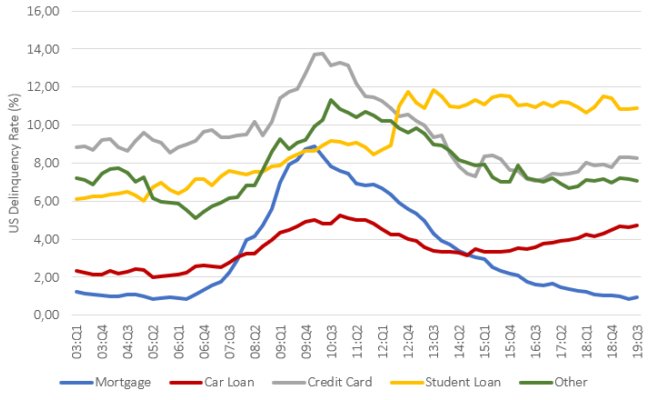

Despite historically low unemployment, overall delinquency rates got worse. At the end of September, 4.8% of total debt was insolvent, up 0.4% compared to the second quarter. More specifically, the insolvency rates of mortgage debt, student loans and car loans increased. The credit card rate, on the other hand, remained constant (Figure 3). In addition, of the $667 billion total of insolvent debt, approximately $424 billion was seriously insolvent (at least 90 days late).

To Conclude...

Overall, in the third quarter of 2019 a deterioration of 0.7% was recorded. Private debt increased, as the insolvency rate, continuing a five-year climb encouraged by low unemployment and consumer confidence. The increase is consistent with the evolution of US consumption, which is constantly growing over the years and which today has reached a level of around $13.345 billion. Higher consumption is also reflected in an increase in the inflation rate from 1.7% to 1.8%. Families, despite wage levels at historic lows, are taking advantage from low interest rates, which have led to a collapse in borrowing costs in recent months. This situation generates concern. In fact, recent estimates have shown that debt, not only for private individuals but also for businesses, is recording very high levels. This could lead to greater difficulties for families in repaying such a high private debt in the event of a future rise in unemployment.