Today US mortgage debt is about 70% of total private debt

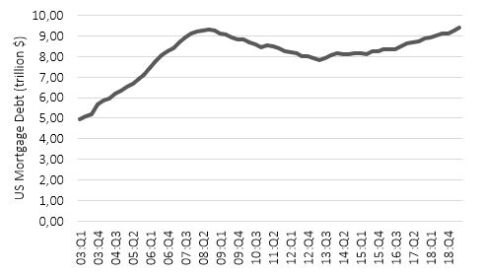

US Mortgage Debt Growth

The US mortgage debt, which in 2008 was the driving force behind the financial crisis that has affected the whole world, has steadily grown in recent years, thus attracting the attention of the sector. It is the main component of US private debt. Today it represents about 70% and its value is around $9.4 trillion, a bit higher than the maximum of $9.3 trillion recorded in 2008 (Figure 1).

Furthermore, if we look at the trend in the US House Price Index (HPI) in recent years, we can observe how it has gradually grown since the financial crisis, reaching a decidedly higher level than the peak registered in 2007. This growth is motivated mainly by low interest rates, which support prices.

Considering the data presented so far, which reflect even higher levels than those of 2008, one could think of the risk of a repetition of what happened in the past.

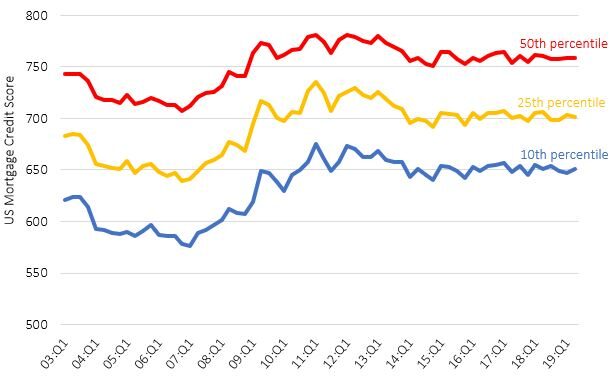

US Mortgage Credit Score

Credit score predicts the likelihood of a consumer becoming seriously delinquent (90+ days past due). A higher score is viewed as a better risk than a lower one. Today the average credit score (Figure 2), for those who receive a mortgage, is around 759, which corresponds to the "very good" level (red line), while only 10% (blue line) had credit scores around 650 (bad level). We can see the difference compared to the years immediately preceding the 2008 crisis, in which the levels of credit score were decidedly worse than today, thus highlighting a lower capacity of debtors to pay.

Credit score significantly higher than in the 2008 pre-crisis period

Figure 2: Credit score significantly higher than in the pre-crisis period 2008

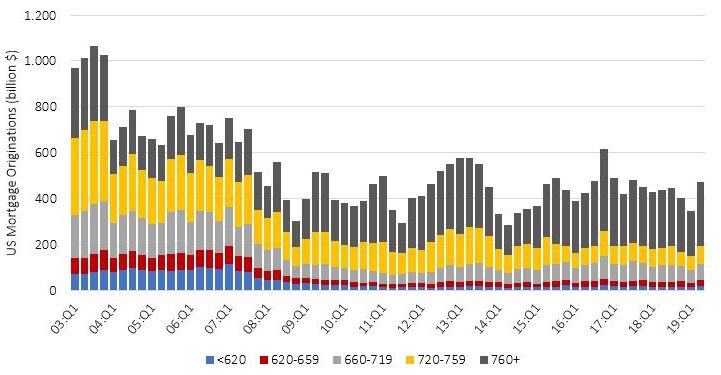

In addition, if we look at Figure 3 which shows the trend in new mortgage loans for each credit score category, it is interesting to note that in 2019 they increased to $474 billion, approaching the levels of 2017. In particular, most new loans are granted to consumers whose credit score is very good. The motivation behind this important movement in originations is linked to the fact that American citizens have increased the demand for loans in order to take advantage of the low interest rates currently imposed by the Fed.

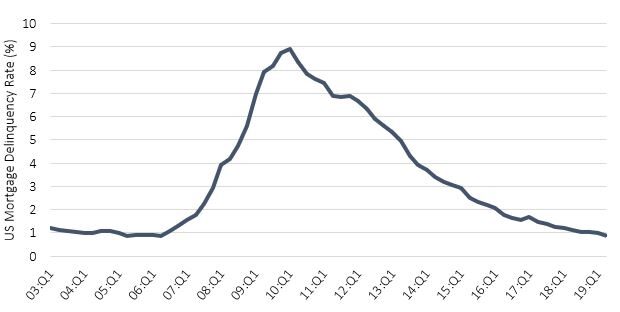

US Mortgage Delinquency Rate

Debt defaults have been reduced. In fact, observing the delinquency rate trend (Figure 4), over the years it has been constantly reduced, and as of today only 0.9% of the mortgage balances are insolvent for 90 or more days. Also in this case there is a difference, although less significant, compared to the pre-crisis 2008 period. The current situation stands at lower levels compared to the 2-3% recorded in 2007.

To Conclude...

In conclusion, although today the American mortgage debt has reached and exceeded by far the peak recorded ten years ago, the risk associated with it seems to be different. As we have seen, debt defaults have been reduced and credit conditions have been strengthened. Today, in fact, the lenders are more selective about who receives the loan, thus reducing the risk that it will not be repaid in the future representing therefore the cause of the outbreak of a crisis as in the past. In addition, the construction of real estate is increasing compared to pre-crisis levels and even in terms of unoccupied houses the signals are not worrying, as we are currently on levels in line with those of the past. In the light of all these observations we think that housing debt does not represent a problem in the immediate future, and therefore that the risk associated with it is lower than in the past.