More than one in two Americans with a credit card has a debt

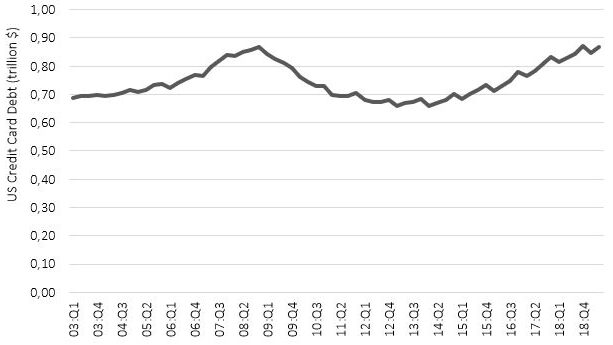

US Credit Card Debt Growth

Nowadays in the United States, the number of people using credit cards has increased. This is a natural consequence of the general growth of household debt, since families have increasingly resorted to credit cards in order to buy houses and cars. Overall, 55% of Americans with a credit card have credit card debt and much of this debt comes from discretionary spending, such as entertainment and the purchase of new clothes. In fact, about 32% of people with credit card debt have defined discretionary spending as the main contributor to their debt. 23% is instead represented by necessities, such as rent and utilities, while medical and travel expenses make up 12% and 9% respectively.

Over the past few years, Americans are accumulating more and more credit card debt (Figure 1). In fact, the level of debt has steadily grown from 2015, reaching today $0.87 trillion, which is a value equal to the maximum recorded in 2008.

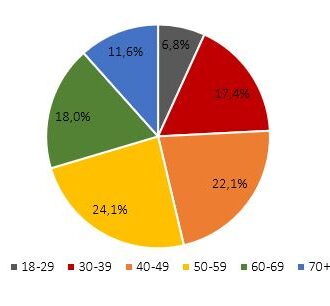

Who Holds the US Credit Card Debt?

If we look at how credit card debt is distributed based on age classes (Figure 2), it is possible to see how the classes with the highest debt levels are the most adult, and that is when in theory the earning possibilities are more. Approximately 24.1% of the total debt is held by adults between 50 and 59 years, while 22.1% by adults between 40 and 49 years. On the other hand, young people (between 18 and 29 years old) represent the age group with minor credit card debt, holding only 6.8% of the total.

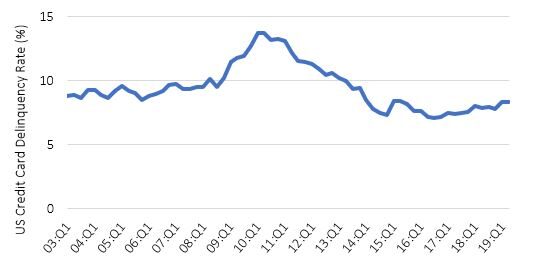

US Credit Card Delinquency Rate

After a constant decrease between 2010 and 2016, in the last few years the credit card debt default rate has started to rise again, reaching today a value of 8.3% (Figure 3). This means that consumers' ability to repay debt is gradually decreasing, thus increasing the risk of insolvency. To date, the credit card sector regarding the percentage of delinquency rate is second only to student debt, which is around 10.8%.

To Conclude...

As analyzed, it is possible to conclude that credit card debt in United States is a significant problem, involving 55% of those who have a credit card, and therefore more than one in two Americans. Surveys have also revealed that most Americans do not believe they will be able to pay their credit cards within a year. This is confirmed by a constantly growing delinquency rate in recent years and it is particularly worrying especially when it involves low-income families. As a result, not understanding credit card debt could have a big impact on people's financial future. Its management is therefore fundamental as less interest and commissions are paid for credit cards, more money consumers will have for future investments or to pay other debts.