Not very significant percentages, but that contribute to further aggravate the economies slowdown.

After developing an analysis on the consequences that the US-China trade deal could have worldwide, we focused on its effects in Europe. Specifically, we analysed data on the main European economies: Germany, France and Italy. For each country we have derived the weight that the estimated losses, given by the decrease in exports to China, could have both on total exports, and individually on agricultural, manufacturing and energy exports. The services component was not investigated due to the lack of complete and reliable data. Furthermore, because of the lack of specific data on the individual goods involved in the agreement, it has not been possible for us to investigate further. However, it would have been very interesting to have them in order to identify any impacts on individual products, and consequently on the companies from which these products are supplied.

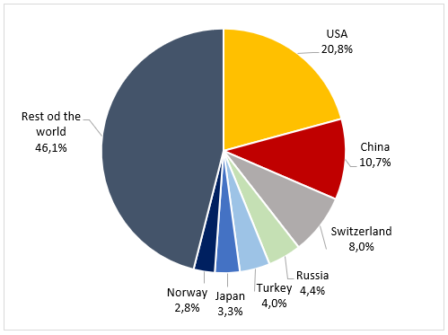

In 2018 total EU exports reached € 1957,8 billion (Figure 1). Exports to China didn’t represent a significant percentage of the total. They were around € 211,3 billion (10,7% of the total). The United States was the main trading partner. The EU exported around €406,5 billion (20,8%). Switzerland was in the third place with €156,3 billion, followed by Russia (€ 85,1 billion). Overall, although the United States and China together account for around 30% of the total, EU exports are highly diversified globally, spreading over many countries.

Considering what has just been described, namely contained EU exports to China (they represent only 10.7% of the total), we now focus on the three main European economies. Germany is the most exposed country in terms of global exports. In 2018 it exported to China about 7,1% of its total exports, while France and Italy exported 4,3% and 2,8% respectively. Germany is therefore the country that, being more exposed, could suffer greater consequences from the US-China trade deal.

Germany

Table 1 shows German data. Germany, as already specified, is the most exposed country, with 7% of exports to China. As a result of the trade deal, the numbers describe an impact on total exports of nearly $7 billion, i.e. a loss of 0,43% in total exports. More specifically, the agricultural sector is the most affected, with a loss of almost 1% by 2021. There is less influence on the energy exports and on the manufacturing exports, where Germany concentrates the largest part of its total exports to China ($101 billion).

Table 1: US-China Trade Deal Effect on Germany Exports (Source: World Integrated Trade Solution (WITS)).

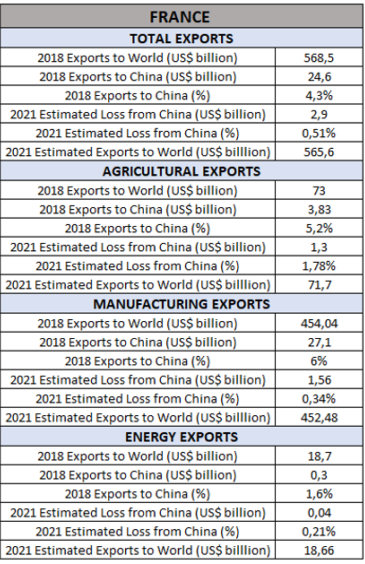

France

As in the case of Germany, the results for France (Table 2) highlight a significant impact on the agricultural component. In fact, according to estimates, the risk for France is to suffer a reduction on total agricultural exports of almost 2% in the next two years. The consequences are less on the energy (-0,21%) and manufacturing exports (-0,34%). In terms of total exports, France is less exposed than Germany, as it exports only 4,3% of the total to China.

Table 2: US-China Trade Deal Effect on France Exports (Source: World Integrated Trade Solution (WITS)).

Italy

Among the three European economies analysed, Italy is the country with the lowest percentages, both in terms of total exports and in terms of exports by single sector. More specifically, at a sector level, in 2018 Italian agricultural, manufacturing and energy exports to China represented 1,1%, 4,3% and 0,3% respectively of the total (Table 1). Moreover, respect for constraints in favour to United States would lead to a 0,25% decrease in total exports. This is understandable as Italy currently exports a very limited part to China. This part does not exceed 3% of total Italian exports.

Table 3: US-China Trade Deal Effect on Italy Exports (Source: World Integrated Trade Solution (WITS)).

To Conclude...

Overall, the direct impact of the trade agreement between the United States and China seems not to be so significant for the main European economies. For all three countries, the biggest losses fall on agricultural exports. Although the percentages are not so high individually, they are not to be overlooked. In fact, we believe that their impact should be taken into consideration as a further burden on the current context, characterized by a general slowdown in economic growth. It is also important to evaluate the agreement not only for the direct effect it could have on the countries, but also for the possible indirect consequences deriving from the triggering of a chain mechanism, in which the decrease of a country's exports could translate in a consequent decrease in its imports, obviously to the detriment of its suppliers.