Significant losses for the world's economies because of the agreement.

The following analysis is aimed at presenting the main points of the US-China trade deal, signed on January 15, 2020. Specifically, we decided to analyse the effects that it could have on the rest of the economy, as we believe this is a point extremely important on which, however, there is a tendency to linger a little.

What Does The US-China Trade Deal Include?

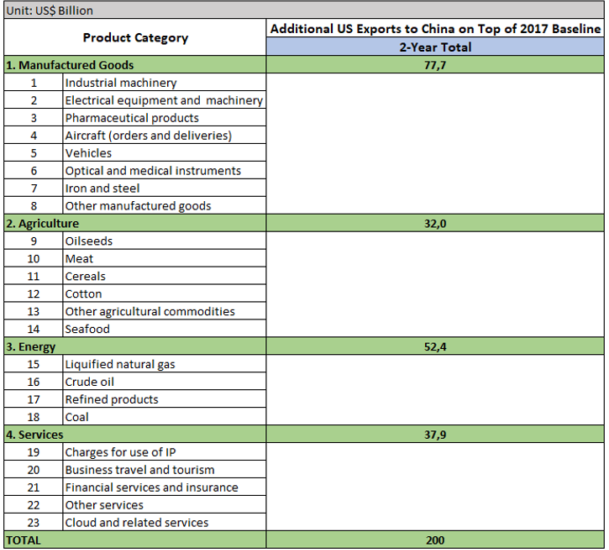

This deal provides several points. It includes stronger Chinese legal protections for patents, trademarks, copyrights, including even better criminal and civil proceedings against online infringement, pirated and counterfeit goods. China has committed itself to eliminating the pressure imposed on foreign companies, forced to transfer technology to Chinese companies to access the market. From a currency point of view, the agreement provides that China will refrain from competitive currency devaluations and will not use its own exchange rate in order to obtain a commercial advantage. The deal also includes improved access to the Chinese financial services market for U.S. companies, such as banking and insurance services. The United States has pledged to cut tariffs on $120 billion of Chinese products from 15% to 7.5%. US tariffs of 25% on Chinese goods worth $250 billion remain unchanged. They could be cancelled in the event of Phase 2. Rates that should have gone into effect on approximately $160 billion of Chinese goods, including cell phones, laptops, toys and clothing, have been suspended, as retaliatory tariffs by of China have, including a 25% tariff on cars made in the United States. However, the focus of the agreement are the purchases that China has committed to making from the United States. In fact, compared to 2017, China will have to buy about $200 billion more of U.S. goods and services over the next two years.

China will import $200 billion more US products and services by 2021.

The Numbers Of The Agreement

China has agreed to increase purchases of American products and services. In 2017, prior to the start of the trade war, $130 billion of US products and $56 billion of US services were purchased. With the recent deal, Beijing has agreed to purchase, by 2021, $200 billion in goods and services more than in 2017 (Figure 1). More specifically, China has committed to purchasing $77.7 billion in manufacturing products. It has also agreed to purchase $52.4 billion in energy products more than $7.3 billion in 2017. In addition, China will purchase $37.6 billion in services from US companies. Finally, according to the agreement, China will seek to secure further purchases of US agricultural products for approximately $32 billion, compared to the reference value of $22 billion in 2017. We move from vehicles, pharmaceutical products, electrical, industrial and medical machinery to agricultural products. Among the latter we find oilseeds (soybeans), meat such as pork or poultry meat, cotton and cereals such as wheat, corn, rice and many others. Moreover, the treaty is about importing live animals, such as swine, bovine animals, sheep and horses. Among the products covered by the agreement there are also those related to the energy sector, such as crude oil. Not only products are involved, but also services, such as financial and insurance ones, or services related to tourism.

Effects Of The Agreement On The Rest Of The World

The commitment that China has accepted is substantial and the numbers to be respected are high. This generates alarm for the countries that currently import into China, as they could suffer a sharp reduction in their exports. In analysing this possibility, we hypothesized two things. Considering China's low growth rate, Coronavirus which may have negative effects on the country over time, and the slowdown in the global economy, total Chinese imports will be the same until 2021. In addition, China's suppliers will remain the same, as well as their export percentages to the country. We therefore assumed that what China would buy more from the United States will be subtracted from other countries according to their percentage of exports.

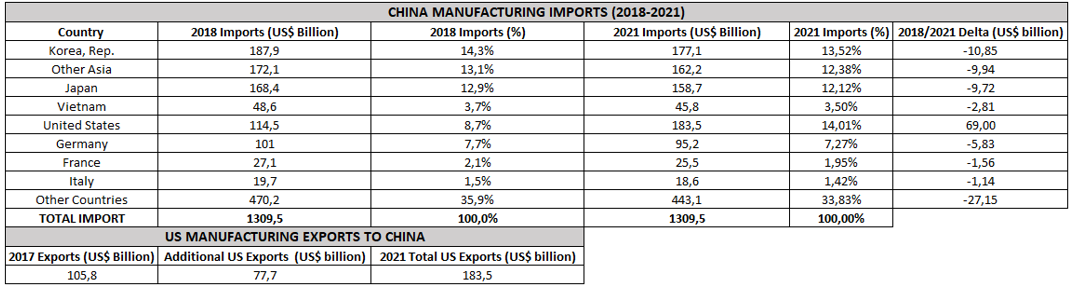

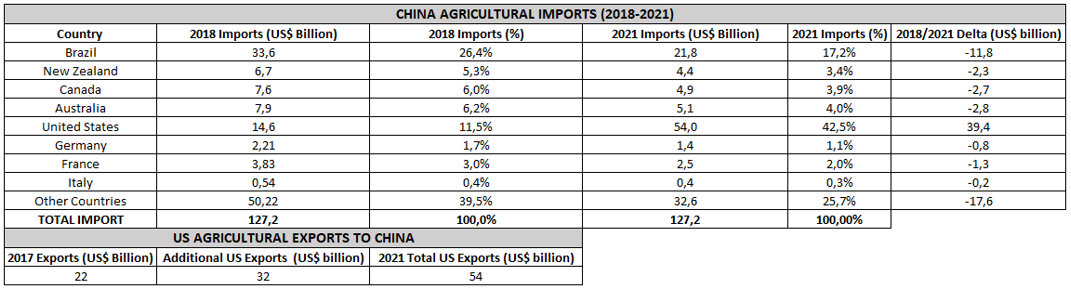

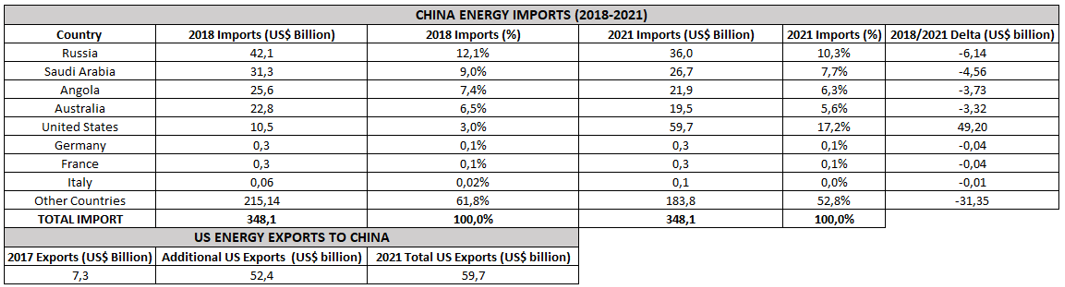

Based on these hypotheses, we analysed the potential effects of the US-China trade deal on the rest of the world. The study was carried out on the individual sectors involved, i.e. manufactured goods, agriculture and energy. For each of them, we presented the value of exports to China in 2018 and the possible decrease that they could face by 2021 against the increase in Chinese imports from the United States (imposed by the deal using the 2017 values as starting levels). The services sector was not investigated, as sufficiently reliable and complete data were not found.

Figure 2 shows the data relating to manufactured goods. We can note that the effects of the agreement could be very severe for most Asian countries, including the Republic of Korea and Japan.

Figure 2: Evolution of China Manufacturing Imports between 2018 and 2021 (Source: World Integrated Trade Solution (WITS)).

In the same way, Figure 3 and Figure 4 present the values concerning the agricultural sector and the energy sector. We observe that Brazil and Russia above all would face very significant losses.

Figure 3: Evolution of China Agricultural Imports between 2018 and 2021 (Source: World Integrated Trade Solution (WITS)).

Figure 4: Evolution of China Energy Imports between 2018 and 2021 (Source: World Integrated Trade Solution (WITS)).

In all three areas, therefore, the results highlight very significant losses because of the agreement.

To Conclude...

As already anticipated in the analysis carried out prior to the signing of the US-China trade deal (https://eicofunds.com/us-china-phase-one-trade-agreement/), we think it is important to consider the impact that it will have on the world. On one side it will bring benefits to the economy of the two countries. On the other hand, we believe that all this will generate losses for the rest of the world. The risk of suffering important consequences is significant. The range of products and services concerned is vast, as are the sectors to which they belong. The agreement provides for very demanding constraints, which China will hardly be able to respect without reducing imports from other countries in the next two years.

In this analysis we studied the situation from a global point of view. Further very interesting insights on the effects of the treaty at the level of individual nations will follow in the next weeks!