US Car debt represents the 9% of US total private debt

US Car Debt Growth

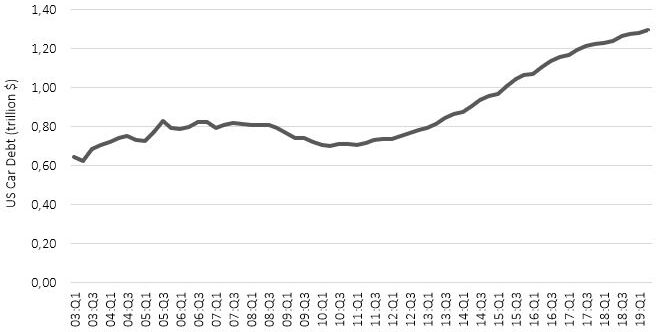

To live and work in most of the United States, having a car is practically a requirement. Jobs, shops, doctors and schools are often inaccessible by public transport and too far away on foot or by bicycle. Owning a car therefore represents the possibility of having a more stable life and a job, factors that will consequently be reflected in the bank account. For this reason, people need cars and so car debts are on the rise in the United States today. After the mortgage and student debt they are the third category of US debts. They represent 9% of total private debt. Over the years, car loan balances (Figure 1) have increased gradually, reaching a new high of $1.3 trillion in 2019.

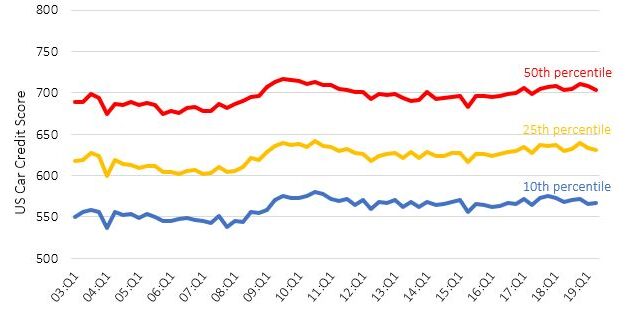

Figure 2: US car credit score (Source: New York Fed Consumer Credit Panel/Equifax)

US Car Credit Score

According to recent estimates, about seven million Americans have stopped paying car debts for several months. This number is very significant, about 1 million higher than that recorded in 2010, a particularly difficult year from an economic point of view. This means that no matter how big the need to own a car in the United States, a very large number of people are unable to save enough. This happens even though today we are in a positive situation from the point of view of employment, with a level of unemployment at historic lows. Focusing on data (Figure 2), we can see that the consumer credit score on car loans is low. 50% is currently at a lower level compared to 740 (“good payer” level) and even 25% is close to a score of 620 (subprime level). 10% is clearly below the minimum. This is an important trend that highlights the high risk to which the car sector is exposed.

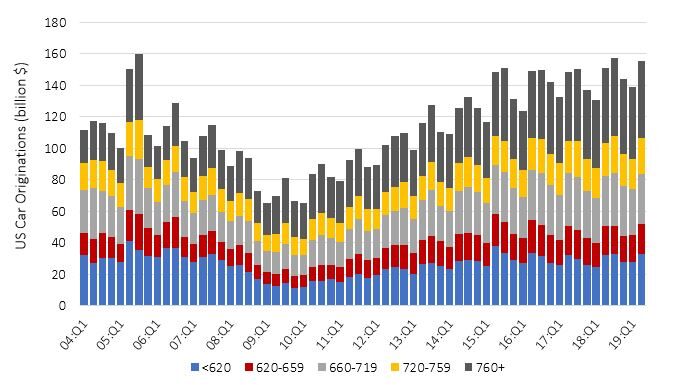

In addition, in the second quarter of 2019, car loan originations increased significantly compared to the previous period, approaching very high levels reached in recent years. What is important to note is that this increase is mainly due to an increase in loans to consumers with a credit score lower than 620 (Figure 3), whose probability of being able to repay the debt is extremely low.

Figure 3: US car originations by credit score (Source: New York Fed Consumer Credit Panel/Equifax)

US Car Delinquency Rate

In recent years, the insolvency rate linked to debts on cars has steadily increased (Figure 4), reaching values very close to the maximum levels registered around 2010. To date it is around 4.6%. This growing insolvency rate trend contributes to reinforcing the concern about debt growth in the car sector and highlights a risky situation.

Figure 4: US car delinquency rate (Source: New York Fed Consumer Credit Panel/Equifax)

To Conclude...

From what has been observed so far, it is easy to deduce that the situation of car debts must be kept under control. Today, loans granted to buyers with low credit scores represent about 25% of all car loans. What is increasing concern is also the fact that the data reveal that, in order to request such loans, people prefer to rely on banks, which in recent years have reported about $368 billion in open car loans. The risk is that delays in the payment of debt could cause difficulties for some credit institutions. This situation leads to rethink subprime mortgages, causes of the 2008 economic crisis. Fortunately, however, the numbers involved are lower: the size of the car loan market is clearly lower than the weight of the housing market. To conclude, a growing number of defaulting borrowers is a clear sign of financial distress for families: as cars are essential, Americans normally tend to give precedence to their payment over others. The fact that families are not compliant with what they consider to be the one of the most important goods is a clear warning sign, a sign of a healthy economy only in appearance, in which, however, the overall level of debt is extremely high and wages are struggling to grow, thus not allowing people to sustain an ever-increasing cost of living.