First five car manufacturing countries:

-China (29%)

-US (12%)

-Japan (10%)

-Germany (6%)

-India (5%)

An Overview On The Automotive Sector

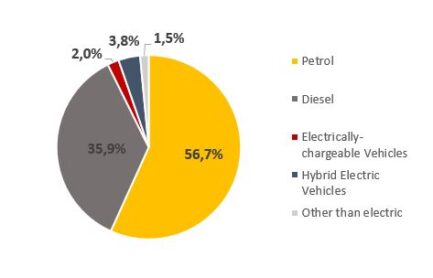

In 2018 the world demand for motor vehicles was slightly lower than in the previous year. Approximately 96 million vehicles were sold (-0.8% compared to 2017). What changed is the market mix by motorization: diesel car sales fell by 18%, while those of petrol cars increased by 12%. Furthermore, sales of alternative fuel cars grew by 28% and to date weigh 8% of the market. From 2006 to 2015 diesel car sales were worth over 50% of the market. In 2018 the share dropped to 36%. That of petrol cars instead rose to 56%. From the production point of view, in 2018 over 71 million cars were produced, with a 3.2% decrease on 2017 volumes. 61% of cars are produced in Asia. This is because due to the increase in labour costs in national markets, European and US automakers have shifted part of production.

To date, China holds an important percentage of the automotive market. Over the years the country has developed a strong culture for joint ventures: the major car manufacturers (General Motors, Nissan, and Volkswagen) have joint ventures with Chinese companies. In addition, for example Volkswagen, the world’s largest producer, presents about 122 plants, of which 33 are in Asia (22 in China alone), against the 28 plants held at home. The joint venture policy has therefore helped China to become the leading Asian and global car manufacturer, ahead of Japan and South Korea. These two countries have strong domestic car manufacturers, among the top worldwide, like Toyota, Nissan and Hyundai.

The Growing Future Of Electric Vehicles

Electric mobility is growing rapidly. It has registered a steady increase. In 2017, over 1 million electric cars were sold with over half of global sales in China. Total number of electric cars in the world exceeded 3 million, with an expansion of over 50% since 2016. In 2018 growth continued. The number of electric cars exceeded 5.1 million. According to data provided by the European Federation for transport and the environment, the forecasts support an increase in the production of electric vehicles in Europe. Specifically, a 60/40 division is planned between battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) and over 330 different models available. The data regarding hydrogen fuel cell vehicles (FCEVs) show instead a decidedly more contained development, with only 14 models designed between Toyota, Volkswagen and Daimler. The projections to 2030 therefore forecast a sharp decline in the diesel and gasoline share in favour of vehicles with electric components. In 2018 they account for about 5-6% of the automotive sector (Figure 1), but in 2030 it is expected that they will be just under 50%.

Figure 1: Components of the automotive sector in

2018 (Source: ACEA)

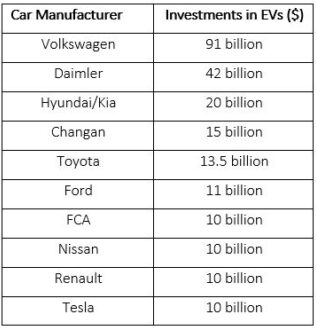

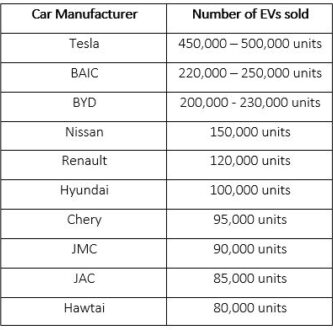

Investments In Electric Vehicles

According to estimates provided by Reuters the total investments expected in the next 5-10 years to electrify vehicles is at least $300 billion, of which about 45% will be spent in China, which is heavily promoting the production and sale of electric vehicles through a system of credits and incentives mandated by the government. Of the $140 billion invested by German manufacturers, half are destined for China, as well as part of the $39 billion invested in the US and the $24.3 billion invested in Japan (Table 1). Out of a total of $300 billion, about $135.7 billion will go to China. These data highlight how the future of the automotive market, in particular regarding electric vehicles, is oriented towards China. Today, Chinese car manufacturers such as BAIC, BYD, Chery, JMC and JAC hold significant positions among the major electric vehicle manufacturers (Table 2).

Table 1: Top ten car manufacturers for investments in the electricity sector (Source: Reuters)

Table 2: 2018/2019 Major electric cars sellers

Investments in the electric sector growth do not only concern cars, but also all the elements to which they are linked. Recent advances in battery production technology bode well for the development of long-range electric cars. Better batteries can store more energy and improvements in production lower the cost of batteries. Today, electric car batteries cost about $176 per kWh, but, according to Bloomberg New Energy Finance analysts, the figure is expected to fall to $87 per kWh by 2025. However, the problem today is the lack of adequate infrastructure of charging. There are about 150,000 public charging points in Europe, but by 2030 at least 3 million are needed, according to estimates by the European Commission. Reduced charging times could be a way to compensate for this shortcoming. Currently there are several companies and industrial groups working on the construction of fast charger networks. General Motors and construction company Bechtel have announced collaboration to build a network of fast chargers. Electrify America, funded by Volkswagen, is building a recharging network. Tesla also has an extensive network of its Superchargers. Companies say that electric cars of the future could be recharged in less than 15 minutes. In addition, replacing millions of petrol and diesel vehicles with electric ones means placing a greater load on the electricity network. According to a JRC study of 2018, if 15% of cars on EU roads were electric in 2030, this would lead to an additional demand on the electricity of around 95 TWh per year.

To Conclude...

From the data reported above, the future of the automotive sector seems to be oriented towards electricity. Investments dedicated to the development and production of batteries, chargers and electric vehicles are significant, a sign that companies are pushing towards this new segment. Not to be forgotten, a further aspect, which over time will contribute to influencing the world of cars, is the ever-increasing phenomenon of car sharing, through which people can renounce the private car, but not the flexibility of their mobility needs. The increased focus on zero-emission vehicles is one of the reasons why we see more and more car sharing services adding electric vehicles. In 2019, 66% of all car sharing fleets were entirely electric or at least offered some electric vehicles. Moreover, in recent years the electric is also involving alternative two-wheeled mobility (bicycles, scooters, etc.), increasingly exploited by people for short journeys. This entails for the future huge investments in infrastructure, in order to adapt the roads to these new means of transport. Considering the above, we can therefore conclude that we are facing a major evolution in the automotive sector, which will become increasingly significant with the passage of time.