Soy is one of the most used raw materials in the food, industrial and energy sectors.

What Is Soy?

Soy is one of the most important raw materials in the food, industrial and energy fields. Soy is an herbaceous plant, belonging to the Leguminosae family. It is a basic component of nutrition, both human and animal, worldwide. Therefore, its demand tends to be high.

Current and Future Use

In addition to be a staple food for both human and animal nutrition, soy and its components continue to be incorporated into industrial products in order to reduce dependence on oil, guarantee a sustainable source of supply and make products more respectful of the environment. Concerns about the environmental impact of chemical detergents have sparked interest in bio based solvents, which also contain ingredients derived from soybean oil. Soy is used in adhesives to replace formaldehyde, believed to be carcinogenic, for the creation of fibres, lubricants and paper. Soybean oil can be used as a drying oil. Due to the hydrophobic nature of soy, oil is also used in paints and coatings, in both architectural and industrial applications.

Corporate sustainability initiatives and consumer demand for safe products are also driving the use of this raw material to replace petrochemicals and additives used in plastics. Lately, the use of soy is also expanding to new fields, such as biodiesel, asphalt repair materials, groundwater bioremediation. Research also continues regarding its exploitation in order to reduce the amount of petroleum-based oil used in tires and other rubber applications.

Production

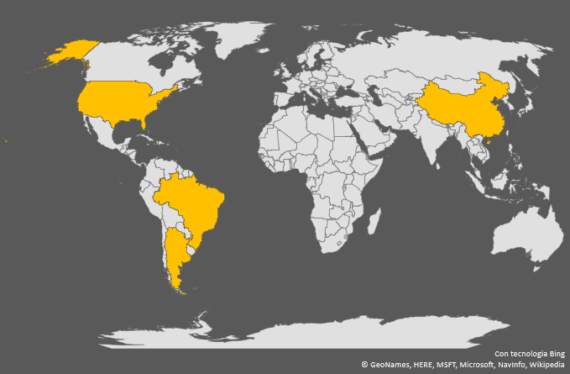

Soybean is native to East Asia, although today it has been exported and cultivated in much of the world. There are three types of soybean products available on the raw materials market: soybeans, soybean oil and meal. To date, the first soybeans producing country is Brazil, which produced about 123 thousand metric tons in 2019, an increase compared to 2018. United States ranks second with a production of 96.623 thousand metric tons, down compared to last year that saw them in first place with a production of 121,000 thousand metric tons. The third country is Argentina, followed by China, Paraguay, India, and Canada. Total production of soybeans in 2019 is around 338.971 thousand metric tons, slightly down compared to the 358.209 thousand metric tons produced in 2018. Soybean oil and meal are made from soybeans. Oil total production is around 57.201 thousand metric tons in 2019, up compared to 2018, and meal total production in 2019 is around 239.710 thousand metric tons, up compared to the 239.710 thousand metric tons produced in 2018. Overall, the United States, Brazil, Argentina and China represent about 80-90% of the world production of soybean and products derived from it (Figure 1).

Factors That Influence Soy Price

The factors that influence the soybean price are different. Generally, price tends to move more during the growing season, as supply expectations can change significantly depending on the area cultivated, climate and growing conditions. According to USDA estimates, today conditions are generally favourable for soybean production in all the main producing countries. Seasonal and climatic changes are perhaps the most influential factors. Crop diseases and infestations can also affect. The price also depends on the demand for soybean products, which when it is increasing correlates directly with the demand for soybeans. The US dollar also has effect. When it is strong, US soybeans are more expensive, which makes US crops less competitive than countries with weaker currencies. Farmers' choices must be considered. Every year they choose between maize and soy. Maize grows in similar climatic conditions, so farmers decide at the beginning of the season which crop to sow, based on state subsidies and costs. If maize is more expensive than soy, then farmers tend to plant more corn. This results in a smaller soybean crop, which is inherently bullish for the price.

Factors that influence soy price:

· Seasonal changes

· Climate changes

· Crop diseases

· Demand for soybean products

· US dollar

· Farmers’ choices

Soy Price Evolution

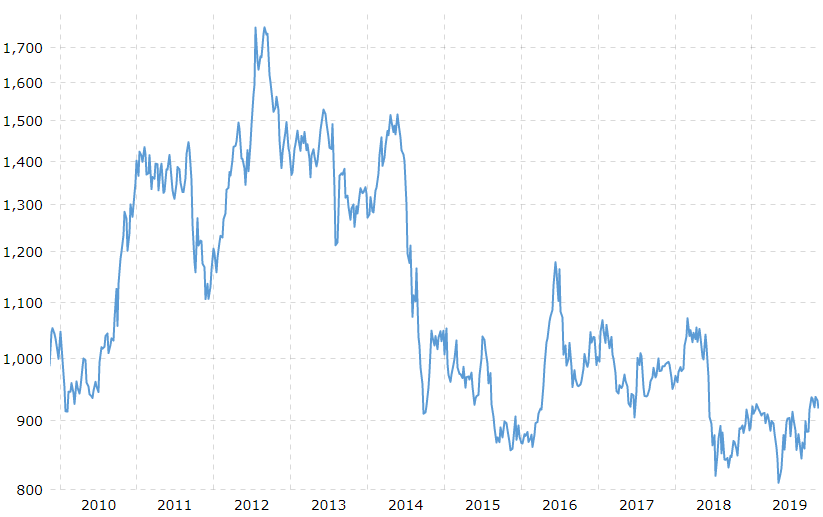

The price of soybeans tends to be more volatile when uncertainties about the harvest increase. In 2016, a shortage of palm oil and a lower-than-expected South American crop caused an increase of the price (Figure 2). In 2014, prices collapsed to their lowest levels in four years. This movement was caused partly by adverse weather conditions in Argentina, partly by an increase in the demand for DDGS. The meal market then collapsed dragging with it the whole soy market. To date, soybeans price is at the lowest level recorded in the last ten years. Soybeans have lost almost 20% of their value since 2018. The cause is the US-China trade war. Over 60% of American soy goes to China. Following the implementation of tariffs in 2018 and a record harvest, stocks in 2019 grew, no longer being absorbed by demand and thus generating a greater excess of supply that brought the price down. However, over the next ten years, the USDA expects US final stocks to gradually decline. Along with a steady increase in the values of soybean meal and oil, it is therefore expected that soybean prices will eventually become stronger. But this will happen very slowly. If tariffs on US imports remain in force for the next ten years, Chinese demand will remain low, having a bearish effect on price. Elsewhere, low prices will push demand, but it is expected that importing countries other than China will account for only 23% until 2028/29.

Figure 2: Soybeans price evolution since 2010 (Source: Macrotrends)

To Conclude...

As we have seen, soy is one of the most important raw materials, which is used in various fields. In recent years, commercial disputes have weighed heavily on the price. Although estimates predict a slow recovery, uncertainty about the future remains high. This is because there are other factors that must be considered and that in the last period are a source of concern for the market. In addition to the negative effect of the trade dispute, the decline in the price of soy has also been attributed to the strength of the US dollar. In addition, there is concern about the spread of ASF (African Swine Fever) in the Chinese pig population. The virus has spread throughout China and is expected to worsen. The risk is that all this leads to the destruction of direct demand for American soybean, further reducing the price.