85% of palladium demand comes from the automotive industry.

What Is Palladium?

A precious grey-white metal, palladium is extremely ductile and easily workable. It is a shiny metal, able to resist corrosion, stable at high temperatures. Palladium is also conductive and resistant to oxidation. Its most incredible property is the ability to absorb large amounts of hydrogen at room temperature. This makes palladium an efficient and safe means and purifier of hydrogen. It belongs to the metals of the platinum group (PGM). It has chemical properties like other metals belonging to the group, but unlike them, it has the lowest melting point and is the least dense.

Current and Future Use

Palladium is often used as a substitute for platinum and gold in jewellery and in the coatings of electrical components. It is also used for decorative purposes and small quantities of palladium are tied with gold to produce white gold. It is used in the field of dentistry, in chemical processes and in air purification equipment. However, several years ago a new field of use was opened. It was decided that the cars should clean up their exhaust fumes, causing smog and pollution. The easiest way to do this was to introduce catalytic converters, in which a key role is covered by palladium. This market has grown rapidly and uses almost all the palladium extracted every year. To date, around 85% of demand comes from the automotive industry.

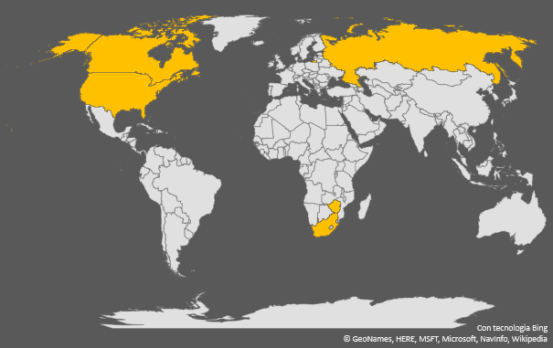

Production

Currently the first palladium producing country is Russia, which in 2018 produced about 85 metric tons, slightly down compared to 2017, the year in which it produced 85.2 metric tons. South Africa is the second largest producer, with about 68 metric tons produced in 2018. 2018 represented a difficult year for South Africa. The country has in fact recorded a significant drop in production (86.8 metric tons in 2017), due to job cuts, strikes and mining closures. Following this are Canada, where production in 2018 remained substantially unchanged compared to 2017 (17 metric tons) and the United States, with 14 metric tons, slightly up compared to 2017. Zimbabwe holds fifth place with a production of around 12 metric tons in 2018, unchanged from 2017.

Palladium Price Evolution

Palladium is currently the most expensive of precious metals: its value exceeds that of gold, silver and platinum. From January 2018 the price exceeded the maximum of $1,062.5 (recorded at the beginning of 2001), continuing to grow very rapidly. In December 2019 the price reached a maximum value above $1950 (Figure 2). As a key component of pollution control devices for cars, palladium has seen its price double in just over a year. In Europe, sales of diesel cars (which mainly use platinum) have decreased, as consumers opt more for petrol cars, for which the use of palladium is required. The high demand compared to the supply has brought prices to record levels. The price is on the rise because the production is failing to respond to the ever-increasing demand as governments are changing and tightening regulations against pollution. Its extraction is almost always secondary, resulting from operations aimed at extracting other metals, such as platinum. Being a by-product of other mining operations means that production growth is limited by increases in production and the development of new mines of other raw materials. This means that production tends not to be synchronized with the increase in demand. The last seven years have seen a net deficit and forecasts say the deficit will continue.

Figure 2 : Palladium price graph (Source: Bloomberg)

To Conclude...

The extremely high price could push car manufacturers to find a palladium substitute, but this is unlikely to happen soon. Platinum (which has reached minimum price levels) could represent an alternative. However, the research carried out has shown that important technological advances would be required so that platinum can match the performance of the catalytic converters in which palladium is present. Therefore, replacing this metal is extremely demanding, expensive and time-consuming. An element that could limit the demand for palladium, and consequently curb the price, is the spread of pure electric vehicles. In fact, they do not use gas and exhaust pipes, so they do not use palladium. However, both plug-in hybrid and pure hybrid electric vehicles use gas engines and therefore this will lead to a continuous increase in demand in the near future. If it will take place, the complete electrification of the entire global automotive industry will require decades before generating a reduction or even the disappearance of the palladium market.