Mistrust of companies and slowdown in industrial production provide signs of a possible collapse of the US labor market.

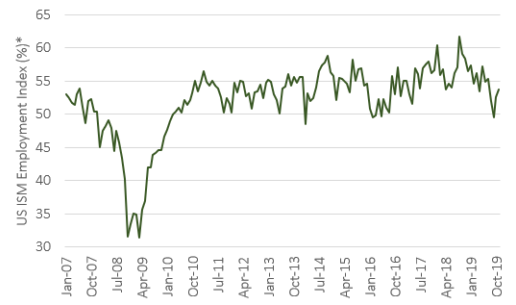

During these years the labor market in the United States has proved to be relatively solid, with unemployment at historic lows. Recently, however, some indicators seem to question the stability of the system, highlighting growing downside risks to employment. Since the beginning of 2018, real US GDP growth has been steadily declining. In addition, in the last year the ISM employment index (Institute for Supply Management) has registered an overall downward trend, passing from 62%, the highest level reached in September 2018, to 53% (Figure 1).

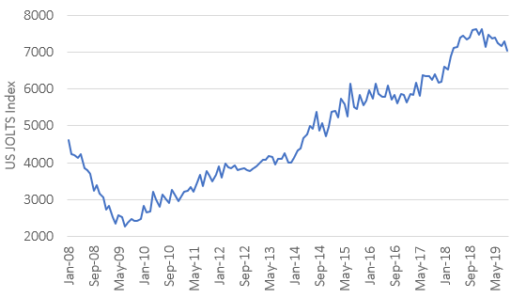

There is also a weakness in another key metric of the American labour market, the JOLTS job openings, an indicator of job offers, which collects data from employers on employment, job opportunities and recruitment. Looking at Figure 2 we can see that the number of job openings at the end of September fell to 7.024 million from 7.3 million in the previous month. It was the lowest level since March 2018, the month in which the index changed direction after years of uptrend.

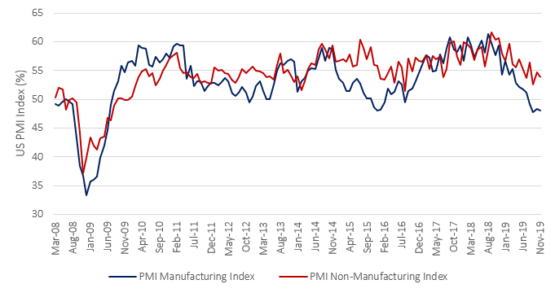

An important signal also comes from the US PMI (Purchasing Managers' Index), which provides information about the prevailing direction of economic trends and therefore the health of the economy, in the manufacturing and non-manufacturing sectors. Over the last year the trend of the PMI, both manufacturing and non-manufacturing, has changed (Figure 3). After reaching the maximum level of around 61-62% in September 2018, both indices began to fall. In particular, the PMI Manufacturing Index has experienced a steep decline in the last year, reaching, in September 2019, the lowest level since the financial crisis.

In addition to these indicators, what makes us think is the great divergence between consumer confidence, high as a function of the highest stock market records and historic low unemployment, and the confidence of CEOs / companies for the future. NFIB estimates (National Federation of Independent Business) show that the percentage of companies planning to increase the number of hires is decreasing. From February 2019, net job creation has changed from 0.52 workers per company to 0.12. This happens for several reasons. US companies are increasingly focused on buying back their shares rather than investing in growth, increasing capital and consequently hiring. Furthermore, according to NFIB data, in 2019 finding skilled workers represents the number one business problem for 25% of companies. The unavailability of suitable labour hinders economic growth. An important element is added to these factors. To date, the US corporate debt is at extremely high levels. Thanks to low interest rates in recent years, US companies have accumulated a large amount of debt. According to estimates, the US listed companies have accumulated a total debt of nearly $10 trillion. This equates to around 47% of GDP. The total corporate debt is much higher. Adding the debt of small and medium-sized businesses, family businesses and other unlisted companies, there is another $5.5 trillion. In other words, the total debt of US companies is $15.5 trillion, 74% of GDP.

To Conclude...

The observed data highlight some relevant aspects that could represent a signal of slowing down of the US labour market. The scarce intention of companies to take over in the future, the decrease of industrial production, added to the low quality of jobs (despite unemployment is at historic lows, more than half of the jobs created in the last thirty years are low-wage jobs) are worrying elements. All this makes one think of the possibility of a future increase in unemployment, aggravated even more by an extremely high level of private debt, which people are unlikely to be able to repay.