In 2019 a significant amount of government and corporate bonds is characterized by negative rates.

The Bond Market Today

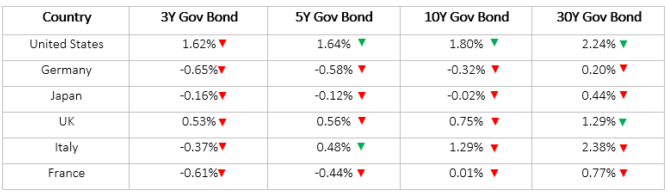

Currently on the market the level of negative yield bonds is very high, amounting to $15 trillion worldwide. This represents around 40% of the global public debt in circulation. The bonds of countries like France, Germany, Japan and not only have negative returns. From the latest data (see the table below) we note that in December 2019 most of the yields of government bonds of different countries are negative, and almost all of them are decreasing compared to last year. Although negative bond yields on sovereign debt are observed, this phenomenon is not limited to government bonds only. Over the past year, returns on a growing number of corporate bonds have also become negative. Although not as prevalent with respect to government bonds, such declines have resulted in the yield on approximately 7% ($1 trillion) of the universe of global corporate investment grade debt also falling below zero percent. What would once have been considered a strange anomaly could now become the norm.

Why invest in negative-rate bonds

How is it possible to have such a large amount of negative-rate bonds? What justifies the fact that an investor, in addition to lending money, must also pay? An answer is linked to tactical/speculative choices, if the investor thinks that the price of the bond will continue to rise. In addition, institutional investors (insurance companies, pension funds, mutual funds, etc.) are often constrained by regulations that require them to invest and hold

securities in the portfolio, rather than maintaining liquidity. For this reason, the institutions buy bonds despite the negative rates. This explains why this market has been generated in recent years. The purchase of these bonds therefore justifies the institutional investor, but not the private one. The latter has no obligations and is free to keep the money in the bank account, thus avoiding the risk of losses related, not only to sub-zero rates, but also to the management commissions that he would have to incur if he invested. The choice of the private to invest in negative-rate bonds makes sense if he wants to hold a speculative position. It makes no sense instead in a logic of portfolio diversification and hedging, as the investor would face a high cost and a potential negative return. However, very often these considerations are not made. We choose to invest in bonds, although the rate is negative, since we are based on asset allocation strategies of twenty years ago. Therefore, it is considered correct and it is advised to diversify by necessarily admitting a bond share in the portfolio. This highlights how taken decisions are excessively tied to custom, decisions that, in our opinion, derive from a very old approach of diversification.

How to diversify your portfolio

In order to properly diversify the portfolio, it is fundamental to know the product in which you are investing, and not to limit yourself to analysing its past performance. In finance there is a tendency to sell the past. It simply helps us understand where we are today and how we got there, but not what will happen tomorrow. We therefore tend to make an excessive reference to the history, without however understanding the real reasons behind it. This highlights an excessive superficiality in the financial field in advising and selling products, which are not fully known, but chosen for their past performance. Obviously, this does not mean not taking an interest in the past, but we must not consider only that. When investing it is important to look to the future. How? We maintain that it is essential to follow a risk/return logic to correctly choose the products in which to invest. It is not possible to know for sure what they will do in markets in the future, so it is important to analyse the possibility of the products in terms of potential loss and return. We base our investment choices on this approach. Over the years we have invested heavily to develop a software system capable of guaranteeing a risk/return calculation that is as reliable as possible. Today, considering what has happened on the market in the last year, a criticism that is being made by someone is the fact that we did not invest in bonds a year ago. In our opinion this highlights a wrong approach to investment. During the last year there has been a change in the approach of the Central Banks, which has led to a change in the market. In addition, a year ago, not knowing what would happen, by analysing the risk/return we would not have invested. Evaluating and judging a choice of investment in the aftermath does not make sense.

Tendency to invest excessively relying on the past history of the product.

To Conclude...

In the financial sphere, and especially with regard to private investors, there is no capacity to explain to the client how it can, in certain market conditions, be more convenient for him to hold liquidity rather than invest. Furthermore, there is little financial competence, as well as a lack of ability to evaluate alternative instruments. In general, the presence of alternative products on the market is very low. Like years ago, even today the asset classes present in most portfolios are two, bonds and equity. Reference is therefore made to an asset allocation that is old, not only from the point of view of distribution, but also because alternative investments are not considered. Most retail market players have introduced alternative instruments such as Ucits funds and private equity. Ucits funds are not strictly absolute return, as they are bound by specific regulations that limit their performance. Private equity can be an interesting tool, but it is subject to extreme conditions and high risk (you invest in unlisted securities). There is a middle way, which is often not considered. Hedge funds, able to guarantee a stronger diversification than the classic one. They are not bound by strict rules, thus having the possibility to adapt to different markets in order to optimize the risk/return ratio and to invest in products that are more adapt to the current market conditions.