Artificial stones are suffocating the natural diamond market.

What Is Diamond?

Diamond is a rare, natural mineral made up of carbon. It is the hardest known natural substance. It is chemically resistant and has the highest thermal conductivity of any natural material. This makes it suitable for use as a cutting tool and for other uses where durability is required. The diamond also has special optical properties such as a high refractive index, high dispersion and high gloss. These properties help to make it the most famous gem in the world and allow it to be used in special lenses where strength, performance and versatility are required.

Current and Future Use

The most common uses, outside of jewellery, are for industrial applications. Since diamonds are very hard, they are often used as abrasives. Small diamond particles are embedded in the blades, tips and grinders. This represents the field of greatest use. However, diamonds find space in many other applications. The diamond windows are made with thin diamond membranes. Diamond speaker domes improve the performance of high-quality speakers. We can also find diamonds in the needle of turntables and in DJ equipment. Recent research has also shown that semiconductors that contain diamonds make electrical current in computer devices much lighter and faster. This mineral is therefore used in computers as a substitute for silicone, but also in heat sinks and as a surface coating in order to limit wear. Finally, diamonds have potential health benefits. Tiny particles (nanodiamonds) are used to help cure cancer. Furthermore, thanks to the extraordinary relationship that diamonds have with light, researchers are testing diamonds on eye implants and bionic eyes.

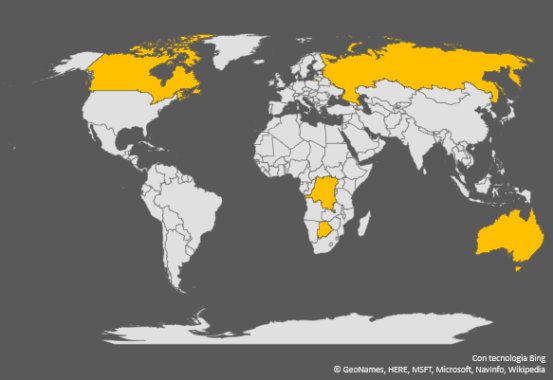

Production

The leading diamond producing country is Russia, which in 2018 produced around 43.2 million carats, slightly up on the previous year in which it produced 42.6 million carats. Russia produced almost double the amount recorded in the same year by the second largest producing country, Botswana (24.4 million carats in 2018 and 23 million carats in 2017). Canada occupies third place, with a production of around 23.2 million carats, which has remained constant between 2017 and 2018. Below is the Democratic Republic of the Congo, with a production of 16.4 million carats in 2018, in drop compared to 18.9 million carats in 2017, and Australia, which produced about 14.1 million carats compared to 17.1 million carats produced in 2017. Global diamond production reached 142 million carats in 2019, down from 148 million and 151 million produced in 2018 and 2017 respectively.

Diamond Market Evolution

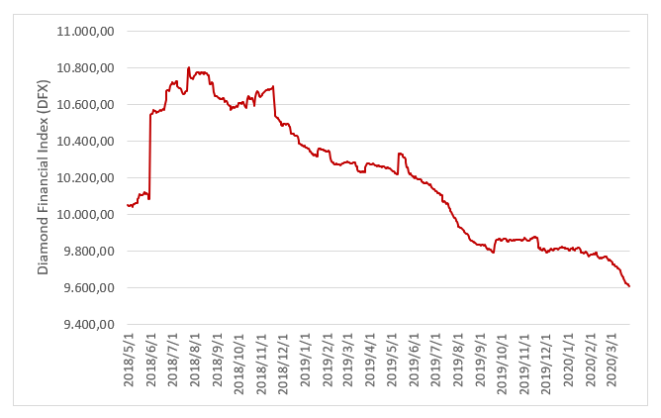

The Diamond Financial Index (DFX) is an indicator of the health of the entire diamond market. In 2019 the market recorded a constant and significant drop (Figure 2). The situation did not change in the first few months of 2020. The DFX trend confirms this. Except for a brief slowdown in the decline at the beginning of 2020, it continued to go down, reaching the minimum level at the end of March 2020. The sales of the two main world producers confirme the crisis. According to the latest data published by Alrosa, after a slight increase in the Christmas holidays (December and January), diamond sales reached $346.4 million in February 2020, down 14% from the previous month. De Beers also suffered a sharp drop. The company sold $355 million in the second cycle of 2020, compared to $496 million in the same period of 2019. In addition, revenues from the second sales cycle were approximately 36% lower than the $551 million in January. The diamond market is suffering negative pressures, due to a significant drop in demand and therefore to an excess of supply increasingly difficult to dispose of. The current economic conditions certainly don't help. The uncertainty surrounding the spread of the COVID-19 virus is weighing further, and will continue to weigh on demand, negatively impacting an already weak market. Before the COVID-19, the economic slowdown and the trade war influenced sales in China, a country that has driven the growth of the sector for years and that in 2019 has recorded a drop in demand of about 5%. Today, considering what has happened in the country, the situation is destined to deteriorate further.

Figure 2: Diamond Financial Index (Source: Investing.com).

To Conclude...

The diamond is a precious mineral, which over time has found application in many areas. To date, however, the sector is in great difficulty. Demand is falling, and oversupply weighs heavily on prices. 2020, despite a slight slowdown in the fall in the first month, is experiencing lower and lower numbers. The market is continuing to decline, certainly weighed down by the current economic situation, but not only. The so-called lab-made diamonds (or synthetic diamonds), produced directly in the laboratories through technological processes, are helping to push the natural diamond market towards ever lower values. Lab-made diamonds are a fast-growing trend. Buyers are driven to this new market not only by cheaper prices, but also by issues of ethical and environmental transparency. According to estimates, this market segment increases between 15% and 20% every year, thus taking more and more foot at the expense of the natural diamonds market.