Contrast between growing financial markets and weak real economy.

2019 represented a particular year for financial markets and for the economy in general. It was one of the strongest years in the history of the financial markets. Markets all over the world collected records, reaching extremely high levels. In contrast to what happened on the financial markets there are the real economies of the main countries, not so growing to support and justify such an upward push.

The Main World Economies In 2019

On a macroeconomic level, 2019 was not a simple year for the main world economies. Despite the United States economy being more solid than those of other countries, according to the latest Beige Book published by the Fed, 2019 was a year of very moderate growth for the country (growth rate of 2.3% compared to 2.9% in 2018). Some districts saw above-average growth, others below-average growth. Labor markets remained tight across the nation. Tariffs and commercial uncertainty weighed on many companies. The same happened in China, where internal crises and international controversies weighed on the country's economy, slowing its growth compared to the previous year. According to estimates published by the National Bureau of Statistics of China, the country ended the year with overall growth of 6.1%, down from 6.6% growth recorded in 2018. Japan posted growth of 1% (compared to 0.3% in 2018), but despite this, investments and exports were weakened by the United States-China trade war. At the end of 2019, industrial production decreased by about 8%. The weakness of the Japanese industrial sector is partly related to the fact that Japanese exports to China fell sharply. In addition, an increase in the national retail sales tax was introduced in October. Over time, the risk is that this plan will lead families to spend less, thus generating a further slowdown in economic activity.

In Europe, Germany's economic growth slowed sharply, recording the lowest growth rate in the past six years. Global trade tensions, weak exports and a persistent decline in the automotive sector influenced Europe's largest economy. The GDP growth rate was 0.6%, significantly lower than the 1.5% and 2.5% growth recorded in 2018 and 2017 respectively. In France, overall, economic growth decreased slightly, passing from a growth of 1.7% in 2018 to a growth of 1.3% in 2019. The unemployment rate fell, and household spending appears to have remained the mainstay of growth. In addition, there was a slowdown in capital investments, in the face of the feeling of easing of companies, particularly in the manufacturing sector. There is uncertainty about what will happen during 2020. Current strikes are expected to contain consumer spending. Moreover, exports, although stable at the end of 2019, could be affected by the imposition of US tariffs worth $2,4 billion as of January 2020.

Overall, according to estimates by the International Monetary Fund, in 2019 the world economy slowed down, growing by 2.9% compared to the 3.6% growth recorded in 2018.

Economic growth of 2.9% in 2019, down from 3.6% achieved in 2018.

The Main Financial Markets In 2019

The data relating to the global economy, which show an overall difficulty and slowdown, are at odds with what occurred on the financial markets in 2019. The equity indices rose, reaching extremely high levels. As for the American market, the S&P 500 increased by 28.9%, the largest annual gain since 2013, when it registered a rise of 29.6%. In Europe, the EURO STOXX 50 index grew by about 21.5%, and specifically, in Germany and France, the DAX 30 and CAC 40 rose by 20.7% and 25.1% respectively. In Asia, the Japanese Nikkei index posted a 16.5% rise, while the Chinese SSE Composite index rose 18.5%. Together with the equity sector, in 2019 the bond sector reached very high levels, driven by very low rates. According to estimates provided by Morgan Stanley, of the 32 large central banks in the world, around 20 cut interest rates in 2019. Strong purchases on bonds pushed the value of negative rate bonds to the maximum.

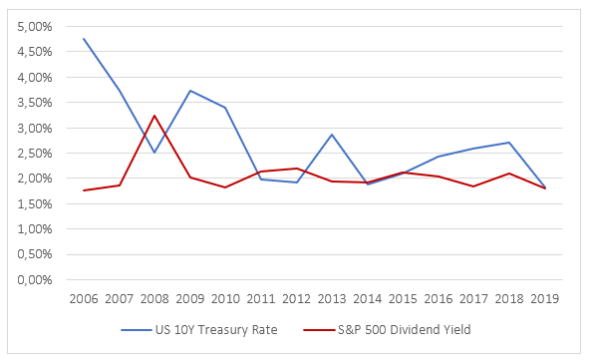

2019 represented a record year, characterized by a growth in all assets. But what supported this climb? The global economy, compared to what presented in the previous paragraph, cannot be considered a support to the financial markets. The policies carried out by the Central Banks certainly contributed. The extremely low interest rates favoured investments thus pushing prices and markets. Furthermore, if we consider for example the United States, the low differential between the treasury rate and the dividend yield (Figure 1), contributed to making investing in bonds more convenient. This differential, which is almost nil to date, shows that in the past there was a premium that has gone to crush today. In fact, at the end of 2019 the S&P500 dividend yield recorded the same value as the US 10Y Treasury Rate.

To Conclude...

Financial markets continued to grow even in the early days of 2020, despite the not completely optimistic outlook. On January 20, 2020, the International Monetary Fund published its forecasts for the coming year, revising them down by 0.1% for 2020 and 0.2% for 2021 respectively, compared to what was stated in the World Economic Outlook of October 2019. The IMF expects growth of 3.3% for 2020. Although the overall figure is higher than the value recorded in 2019, estimates for some of the main world economies (United States, China and Japan) predict a drop in growth for 2020. Downside risks remain important, including the increase geopolitical tensions, between the United States and Iran, the intensification of social unrest, the further worsening of relations between the United States and its trade partners and the deepening of economic frictions between other countries. A materialization of these risks could lead to a rapid deterioration of sentiment, causing global growth to fall below the expected estimate.

To date, markets are reaching extremely high levels, as well as uncertainty about what could happen. Such uncertainty is linked to the difficult interpretation of the current situation, expression of an anomalous situation, in which markets are not supported by the real economy and in which both bonds and stocks are at extremely high levels, thus distorting the historical inverse relationship between prices of the two instruments. The potential risk for the future is therefore substantial. This is well expressed for example by the options market. In the face of very limited volatility, which seems not to consider the current situation and the great future unknown, the premiums paid by the options are very low. This highlights how the market is accepting very low premiums in relation to a very high future risk which is currently extremely underestimated.